With the beginning of another week living “Safer at Home”, the California Association of Realtors (“CAR”) released the “Coronavirus Addendum or Amendment” (CVA). This is an update to the Coronavirus Addendum/Amendment released last week. CAR also released a companion document entitled “Notice of Unforeseen Coronavirus Circumstances” (“NUCC”).

Recently, we discussed the CVA and addressed its use, as well as some of its shortcomings. These newly released documents appear to address at least some of our concerns.

As stated in our last post, the CVA is a force majeure clause. A force majeure clause excuses a party from performing, provided performance becomes implausible or impractical, because of some unforeseen or unanticipated event. COVID-19 is clearly an unforeseen or unanticipated circumstance.

In case there was any doubt, the updated CVA’s title shows it can be used as an amendment to an existing agreement or included as part of a new residential purchase agreement.

Moreover, a party who wishes to amend an existing agreement may sign and present the CVA to the other party in a transaction. If the CVA is not countersigned within 3 days, it expires.

Also, whether used as part of a new agreement or an amendment to an existing agreement, the CVA only applies if both parties agree. A party cannot unilaterally impose the CVA on the other party. This was the case with the original CVA, but the updated CVA resolves any doubt.

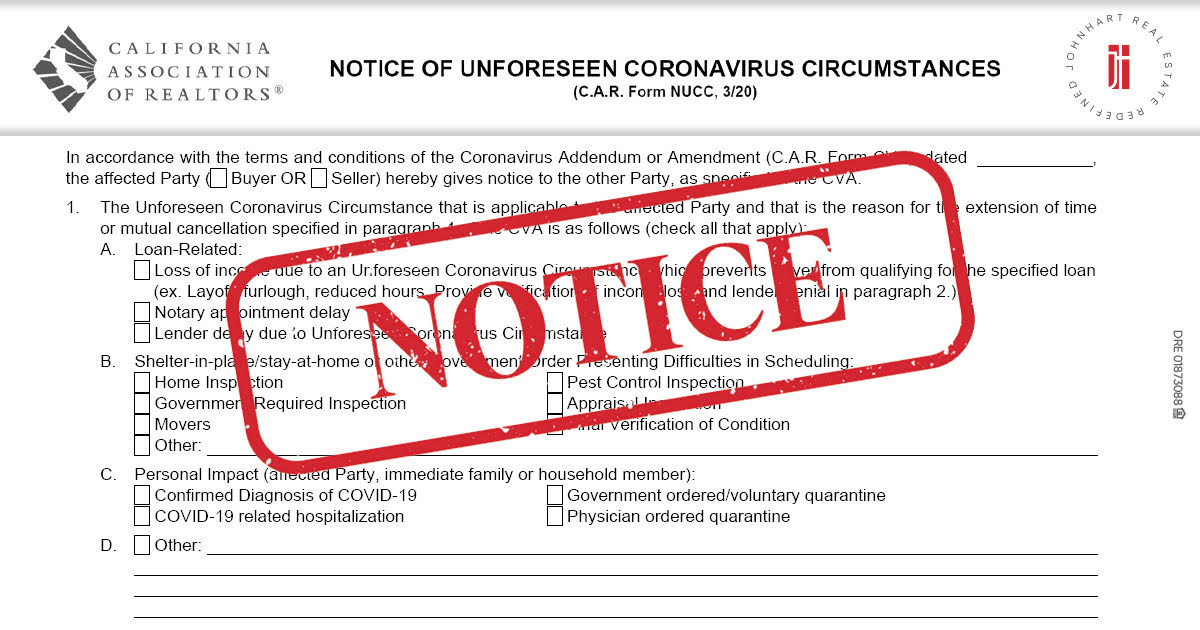

The most noticeable change from last week’s CVA is the introduction of form NUCC. Pursuant to the terms of the CVA, if for some reason unforeseen circumstance related to COVID-19 occur, the affected party is required to execute the NUCC and deliver it to the unaffected party, whether that is Buyer or Seller.

Looking at the NUCC, it provides 3 different categories for the unforeseen circumstance, which are loan related, shelter in place/stay at home or government order, and personal impact. The affected party is to choose a category and place a check next to the circumstance that explains the reason for using the NUCC. There is also a fourth category, where the affected party can add their own reason.

While the NUCC provides a process for declaring an unforeseen circumstance, as well as additional guidance on what qualifies as an unforeseen circumstance related to COVID-19, the language is still broad.

As a result, the affected party should provide a detailed reason for declaring an unforeseen circumstance and thoroughly explain how it is related to COVID-19. If the affected party can provide a reasonable and logical link between the unforeseen circumstance and COVID-19, they should not have any problems.

After delivering the non-affected party the NUCC, the provision checked in paragraph 4 of the CVA will be implemented. These include the extension of time for Buyer to remove contingencies, the extension of escrow or mutual cancellation. The items in paragraph 4, while slightly different in language are substantively unchanged from the original CVA.

As we stated last week, only time will tell whether this amendment is used by agents. If it is used, the amendment will at least provide weary Buyers and Sellers some comfort knowing they can get an extension or cancel the agreement.

Contributor, designer & admin for JohnHart Gazette.

Thank you for the update/information.

Thanks for taking the time to discuss this, I feel that I love to read more on this topic. Such a great and informative article.