Over the course of the last two weeks, our lives have drastically changed. The emergence of the worldwide Coronavirus pandemic has created uncertainty in the economy not seen in years. It was inevitable that this uncertainty would present itself in the real estate industry. Like most brokerages, we have seen our share of listings canceled, but this uncertainty has yet to affect any individual transaction.

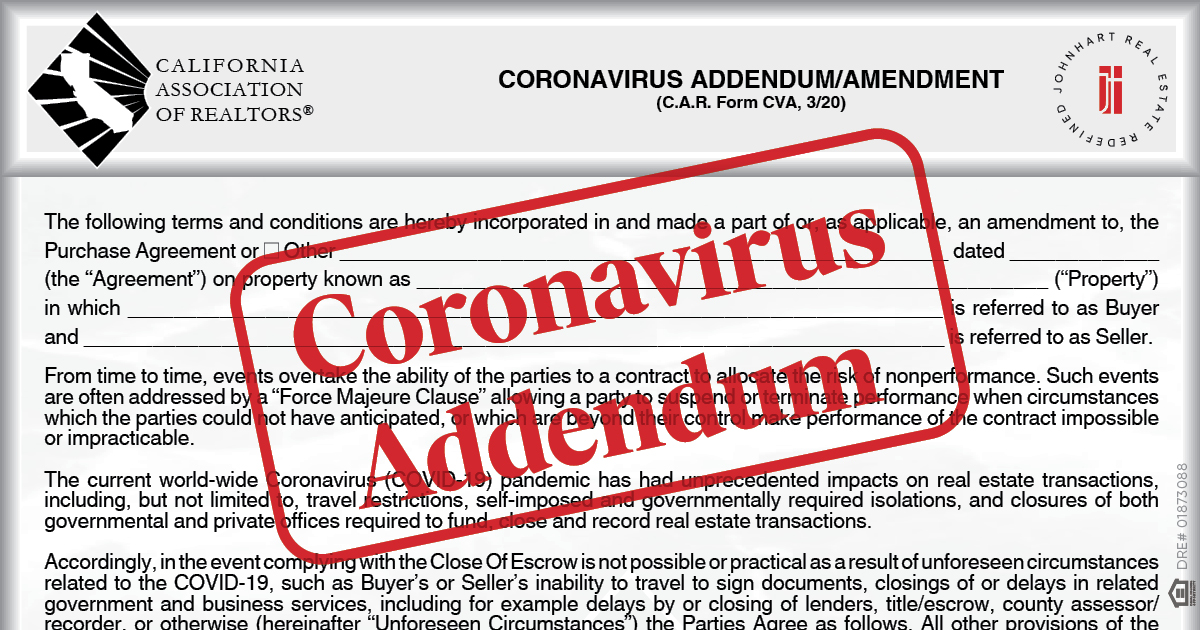

To address this uncertainty in the real estate industry, The California Association of Realtors (CAR) has released a form entitled “Coronavirus Addendum/Amendment” (“CVA”). The CVA essentially allows a Buyer or Seller to postpone or cancel an agreement if they are prevented from closing a transaction because of “unforeseen circumstance related to the COVID-19.”

The CVA is what we call in the legal profession as a force majeure clause. A force majeure clause excuses a party from performing under a contract, if their performance becomes implausible or impractical, because of some unforeseen or unanticipated event. In our case, COVID-19.

In analyzing the CVA, the basis for the entire addendum is the following language, “unforeseen circumstance related to the COVID-19.” This language is extremely broad and lends itself to interpretation.

However, the CVA provides some guidance on how to interpret the language. The CVA lists such examples as Buyer or Seller not being able to travel to sign documents or delays caused by lenders or government agencies. The point to be taken from these examples is that the unforeseen circumstances must be directly related to COVID-19.

In analyzing the CVA further, the addendum will at a minimum allow Buyer and/or Seller to postpone escrow because of unforeseen circumstances. The suggested length of postponement is 30 days but can be longer by agreement of the parties. If the escrow cannot be closed by the end of the postponement period, either party may cancel. It is important to note that notices to perform or demands to close escrow forms will not be required. A party can simply cancel.

The addendum also contains two alternate provisions. The first provision at paragraph two of the addendum allows Buyer to cancel the agreement, whether or not the loan contingency has been removed, if they are unable to fund their loan or close escrow because of a loss of income. This provision addresses the fact that there are Buyers who may have been able to obtain financing prior to COVID-19, but because of loss of employment or reduced income are no longer eligible. The unique aspect of the provision is that it allows the Buyer to cancel even if they have already removed their loan contingency. As such, it is important that Buyers and Sellers are counseled about this fact.

The second provision allows Buyer and Seller to mutually cancel the agreement if unforeseen circumstances arise, without any postponement period.

It should also be noted that paragraph 4 of the addendum provides Buyer and Seller the opportunity to place additional provisions in the addendum, but it should only be used on a transaction by transaction basis. Most Buyers and Sellers will find that the addendum is quite comprehensive.

Also, the addendum can only be used if both Buyer and Seller agree.

Finally, the next few weeks will determine whether the provisions outlined in this addendum will be needed. The hope is that the addendum will not be needed, and this pandemic will soon pass. In the meantime, as Realtors you must be prepared for what happens and protect your clients accordingly.

Contributor, designer & admin for JohnHart Gazette.

If the buyer cancel the transaction just before closing date due to unforeseen circumstance related to the COVID-19, can they get the deposit back?

I signed a purchase contract to buy a new home in CA back in October 2020. I am a non-contingent buyer and provided stock portfolio for funding.. However, the funds have eroded and I can no longer buy the home that is to be ready in July of 2020. Do you think I can get earnest money deposit back since it is out of my control with COVID 19. I can’t even list my current home according to my agent and even if I do they are saying I probably will not get the price I need to pay for the new home. advise?

Does the addendum apply if it is not used during a contract to purchase a house?

If a buyer submits it, and a seller counters without it, and the buyer signs the counter, is any part of the addendum active? Can for example, item #1 give the buyer an extra 30 days to close, and afterwards walk away if not closed? (If sellers never signed the addendum, made a counter that didn’t include the addendum, and buyers accepted the counter-offer?)

Neither my real estate agent, nor a real estate attorney with 48 years experience is able to answer this.

Both say “COVID-19 is uncharted waters.” That does not make me comfortable as a seller.

Is it for resale home only? I was going to buy a newly built home that was sub boded to be built in September 2020. I had to cancel it few days ago because of Covid 19 and it’s effects on selling of my current home. Seller doesn’t accept this addendum and say that was not part of my contract and has kept my earnest money. Is it for resale homes only as sellers claim??