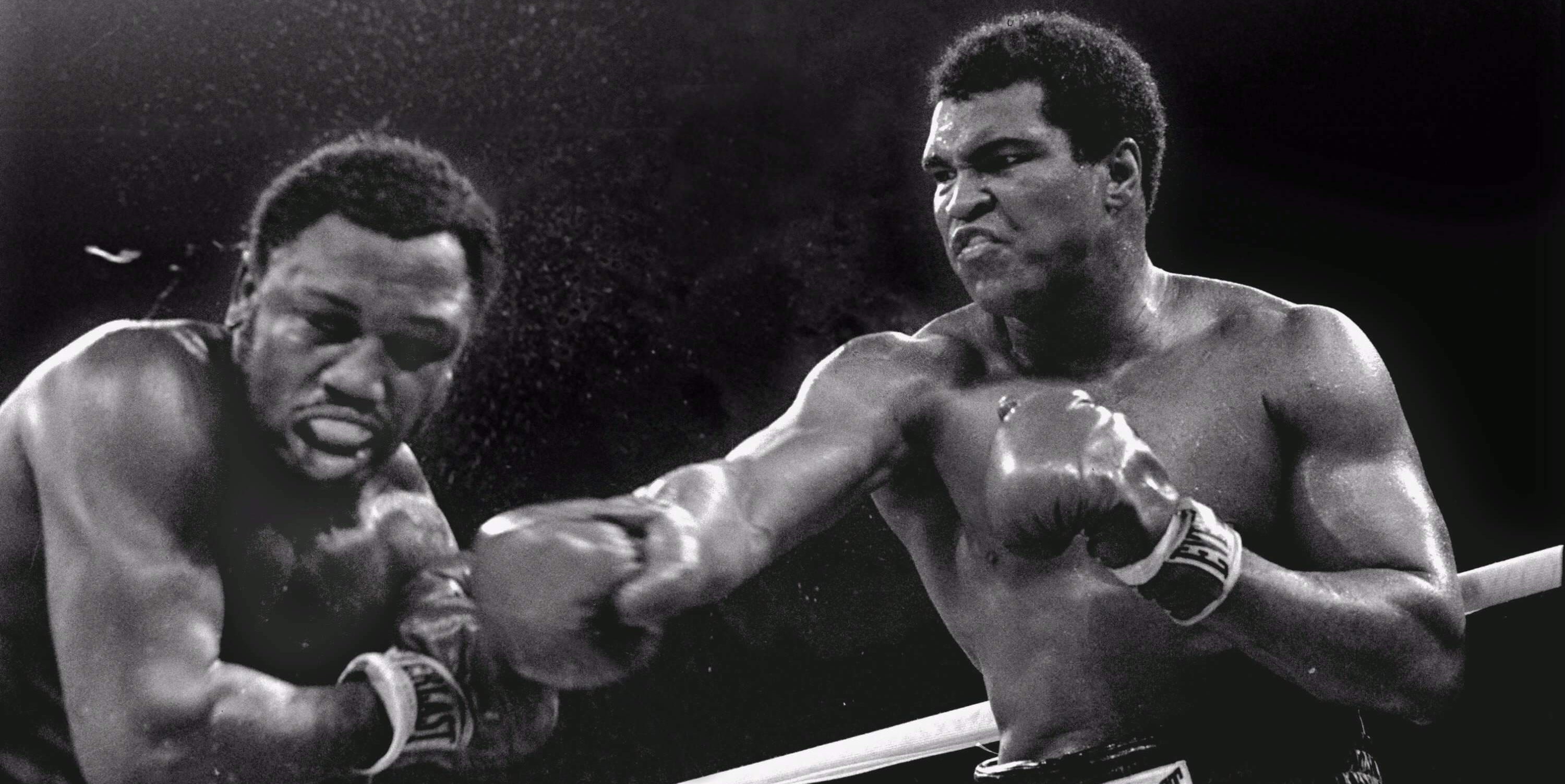

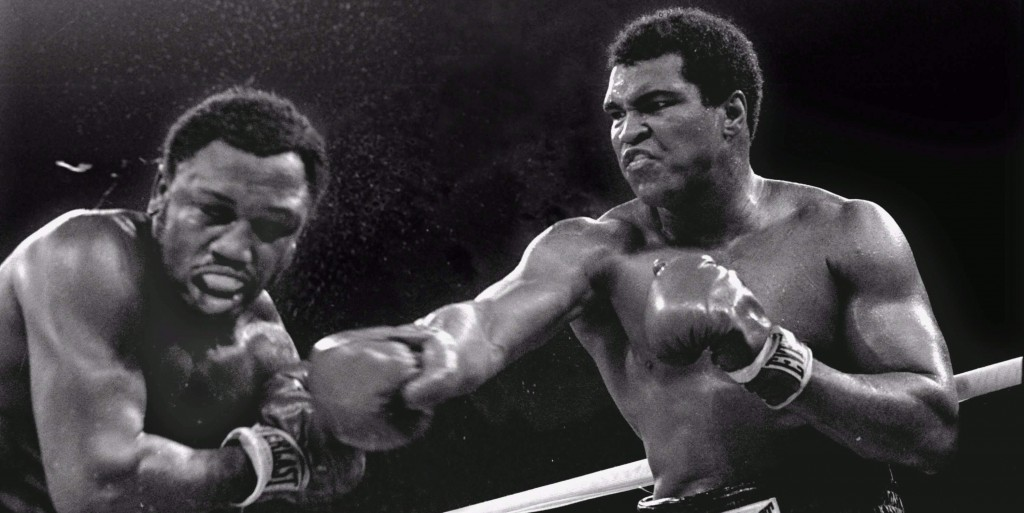

Are you winning the fight but losing the battle?

There aren’t too many of us these days that have not either been through it or know somebody that has been faced with foreclosure. And for those who haven’t been forced to make the decision on whether to seek a modification or short sale it may seem like a clear financial decision to make. While it may be easy for one to look at the financial facts and say cut your losses and move on, but the reality is that they are not emotionally invested in the decision which makes it much easier to do the right thing.

In order to fully understand the decision that many millions of Americans have to contend with you must first understand the mindset and the arena that the battle is taking place in. The government, banks and media would have you believe that it is YOU vs BANK and that you are winning since the roll-out of federally mandated loan modification programs. The plain truth is that the only fighters in this bout are YOU vs PRIDE, and the banks fuel this fight with HOPE hyping you up with dreams of hanging on to your title of homeowner because that’s all it is without the possibility of ever having equity. Then there is the ugly truth that this is a fixed fight designed so the inevitable loser will always be the homeowner.

To prolong the fight, HOPE in the form of promised principle reductions and loan modifications are constantly fed to the homeowner effectively drawing out the battle until the fighter has nothing left to fight with. In short, loan modifications are simply a waste of time, energy and money and those who are faced with this kind of fixed fight should always consider

the following:

- The Government will side with the banks (because they are just too big to fail)

- Banks are always working in their OWN best interests (principle reductions are not likely)

- Banks are regulating foreclosures so they don’t flood the market with empty homes

- Banks would rather keep you paying a reduced mortgage until it is time to foreclose on it

Considering the statements above, you begin to see why loan modification programs that are only supposed to have a three month trial before becoming permanent end up being a 9 – 12 month battle with lenders over missing documents that have been repeatedly faxed until the home is ultimately foreclosed upon. Or why permanent loan modifications almost always have a balloon payment in the 27th year for all of the arrears in one shot, there goes your retirement! My favorite is the Step-Rate Modification which starts at a really low rate and then slowly rises back to your original rate & term with all of the arrears added to the end of the loan. All of these programs may seem very different and hopeful but they all have one thing in common, the bank never loses!

In the end, no matter the program hype they are always designed to keep you in the fight and paying a mortgage until it is finally time to begin foreclosure proceedings. Coming to terms with this is no easy task as are most conflicts when dealing with pride of ownership. If one can separate the emotions of all the time spent on DIY home renovation projects and memories in the home it will become clear that the battle is best won by a short sale. A short sale allows the homeowner to recover and escape the debt of over-inflated home values that the housing boom produced.

Once you realize that it may take more years than you will be alive to recoup any kind of meaningful equity in your present property you have won the battle. Avoiding the long fight of loan modification and subsequent foreclosure which erode your savings and delay your efforts to rebuild will be the best decision you could make under these circumstances. Most are able to establish savings and jump back into the housing market within 2 years after a short sale in contrast to the 7 years after a foreclosure. With real estate prices and lending rates at lifetime historical lows, this would normally be a no brainer if it weren’t for the emotional influence that HOPE has over an individual.

In conclusion, don’t believe the hype and don’t fight the long fight! Save yourself the pain of digging out of deepening debt incurred by loan modification. If Morgan Stanley (one of the largest traders of the bad mortgage debt that kicked-off the Great Recession) can walk away from several buildings in San Francisco to cut their losses and a few short years later reporting better than expected earnings why can’t the average homeowner? The Short Sale option provides the homeowner the means to cut their losses and begin rebuilding their savings to fight another day.

Contributor, designer & admin for JohnHart Gazette.

Excellent article. Clear and to the point. Thanks for share.

Great article. I will share with my clients

Olivia thanks for the feedback! Have a great day!

Thanks for the support Nicola! Best of luck!

I have to say that I’d pick a short sale over a loan modification as well. If you get a loan modification, there’s really no telling what your finances will be like in the future (if you’ll manage to turn your luck around this time, or if you’ll sink deeper into debt). In a way, with a short sale, you’re still in control of what will happen to you financially. At least you’ll manage to dodge the foreclosure bullet and live, as you put so appropriately “to fight another day”.