The Los Angeles County Development Authority (LACDA) launches the Small Business Stabilization Loan Program today, January 28th, 2021. Clearly, the pandemic is wreaking havoc on businesses small and large. Therefore, LA County is choosing to act (whether it is too late remains to be seen). As California continues to grapple with the ever-changing landscape for businesses, the U.S. Economic Development Administration issued this $10 million business recovery assistance fund.

What does it mean for small business owners?

This loan program for small businesses provides eligible companies with a competitive interest rate for loans. As a result, business owners in Los Angeles can now apply for loans between $50,000 to $3 million. Click here to get started.

Which Businesses Qualify?

LACDA utilizes numerous factors to qualify eligible businesses:

- Must prove 2 years of operation

- Business owners must be seeking working capital, equipment purchases, real estate acquisition, or refinancing of existing loans at higher interest rates

- Must maintain an “active” status with the Secretary of State

- The borrower must show good credit management with a minimum FICO score of 620 (a hard pull credit report is required)

- Borrowers must provide a hardship statement with an explanation of what has been done to address the COVID-19 impact on the business. Above all, they must address how loan funds will address the COVID-19 impact.

- Tax returns for two years showing stable income. In other words, the borrower must produce financial statements for 2020 and projections for 2021 and 2022

- LACDA calculates the business owners’ ability to repay the business loan using earnings before taxes, interest, depreciation, and amortization from the business’ last full fiscal year. The borrower must provide all of the aforementioned financial documentation

- All owners with 20% or greater ownership interest must provide a signature guarantee. Entities with multiple owners and less than 20% ownership must present a guarantee provided by the managing member or key employee/manager. The LACDA may require additional owners to guarantee the loan (regardless of ownership interest). In addition, spouses of married borrowers must sign the guarantee.

Important Loan Details

There is plenty to unpack regarding this loan and the application process. For instance, the official website that details this loan and the application process provides a list of ineligible businesses, which you can see here. In addition, the interest rate for the loans is a Fixed Wall Street Journal Prime rate (currently at 3.25% at the time of this posting). LACDA laid out specific loan terms per industry, as follows:

- Working Capital – 5-7 years

- Equipment – up to 10 years

- Real Estate Acquisition and Construction – up to 20 years

Repayment

The repayment plan for these loans appears to be lenient and generous. Obviously, LACDA is prioritizing small businesses and is doing its part to help owners breathe easier. Firstly, they are deferring loan payments for the first 12 months for non-guaranteed loans (interest will accrue). Secondly, payments will be due and payable on the 13th month after the funding date. Loans guaranteed by the Disaster Relief Loan Guarantee Program are subject to interest-only payments for the first 12 months. Moreover, there is no prepayment penalty and a Uniform Commerical Code filing is required.

Origination Fees

You may be asking, what about origination fees? In short, there are none for loans under $100,000. Meanwhile, loans above 100,000 incur a 1.5% fee. By comparison, there is an origination fee for loans guaranteed under the Disaster Relief Loan Guarantee Program. That is to say, there is a 2.5% fee of the loan amount plus $250 for document processing.

Uses of Funds

The loans are eligible for multiple uses, including:

- Working Capital

- Equipment

- Inventory

- Real Estate Acquisition

- Refinancing of existing loans

Additionally, loans must be used for job creation when they are in excess of $75,000. More specifically:

Job Creation

To clarify, business owners must retain or create one full-time equivalent job per $75,000 of loan assistance.

Collateral Requirements

LACDA does not require collateral for all loans in this program. However, certain loans do require collateral to be approved. Here’s what you need to know about loans with a collateral requirement:

- The purchase of equipment under $100,000 requires collateral. Liens will be placed on equipment purchases.

- Every loan guaranteed under the Disaster Relief Loan Guarantee Program (learn more here)

- All loans exceeding $100,000. There is a 70% minimum collateral coverage in place, subject to review on a case-by-case basis. Collateral coverage is determined by dividing available collateral by the loan amount.

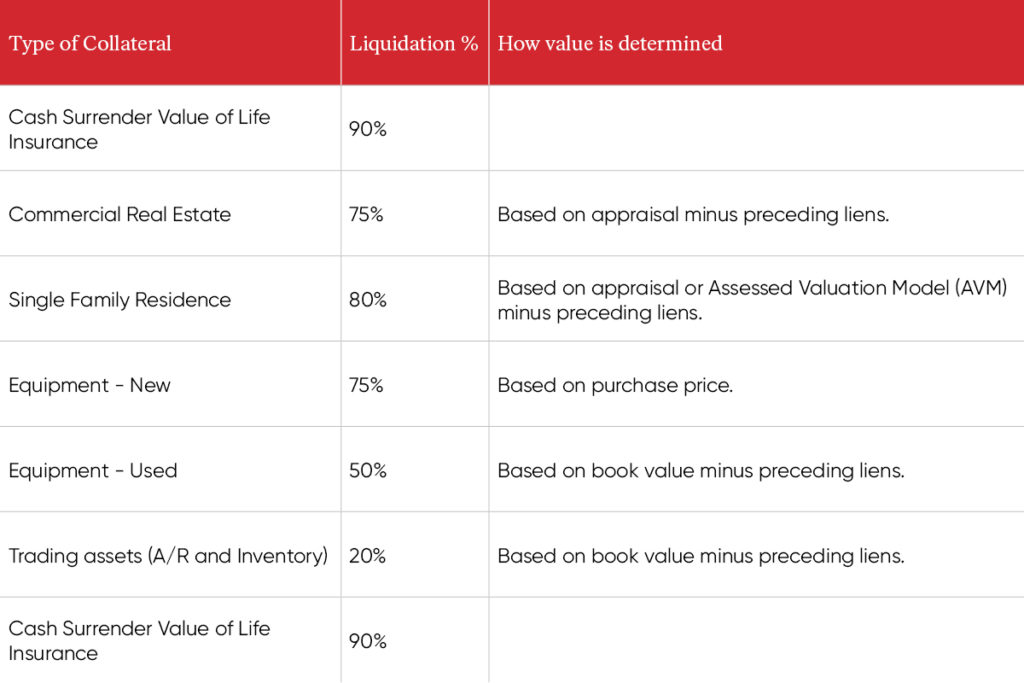

Collateral is established by taking a liquidation value of each asset pledged as collateral. That liquidation is based on the liquidation percentage in the chart below, plus the subtraction of any preceding liens.

For the full breakdown of this program, including information about collateral and business and owner requirements, click here.

Welcome Relief

Los Angeles County Board of Supervisors Chair Hilda Solis noted the dire need for the loans, saying:

“The recent surge in COVID-19 cases is once again harming the vitality of small businesses in the County of Los Angeles.” She continued, saying “The launch of LACDA’s Small Business Stabilization Loan Program will help guide our local small businesses to recovery and set them on the path to long-term prosperity. Our economic healing depends on the wellbeing of this sector and their employees.”

-Hilda L. Solis, Chair of the Los Angeles County Board of Supervisors

Round Two

Today’s loan program marks the second time the LA County Board of Supervisors provided aid to small business owners. The Board developed the Small Business Recovery Loan Program in the early weeks of the pandemic (April 13th, to be exact). LACDA administered that program as well. However, the two programs are not the same. Numerous differences separate the two programs. For starters, the original April 2020 loan program was directed at a more focused, acute group of small business owners.

Let’s break down how the two loan programs differ. Firstly, the Economic Development Administration (EDA) funded the April 2020 recovery loan program. Secondly, businesses needed to qualify for the program itself. The prerequisites included:

- For-profit companies with 25 or fewer employees located within the unincorporated Los Angles County or city

- Companies participating in the County’s Community Development Block Grant Program

That previous loan amount was comparably lower as well. Business owners could apply for a $20,000 loan with a term of five years. In addition, the loan proceeds were usable for working capital, including payroll or rent. The EDA authorized the minimum interest (4%) or Wall Street Journal Prime (75%), whichever was lower. Additionally, the principal and interest payments were deferrable for up to 12 months. Business owners at that time were able to prepay their loan in part or in whole, at any time, without penalty. Lastly, LACDA offered the loans without a loan origination fee and without requiring collateral to secure the loan.

How To Apply

Applicants must attend an online webinar (Applying for an Affordable & Flexible LACDA Loan) to learn about the requirements of the application process and necessary documentation. After that, LACDA connects applicants with a Technical Assistance provider. Subsequently, the technical assistance provider will assist with the remainder of the business loan application. LACDA is currently accepting applications, and the program is slated to remain open indefinitely. Learn more about the process here.

This hopeful news comes on the heels of Governor Newsom’s latest announcement to cancel the stay-at-home order and curfew. Though California appears to be many months away from a return to some semblance of normalcy, these latest updates indicate steps in the right direction. Hopefully, small business owners take advantage of the loans and pursue every venture possible to stay afloat during these trying times. So, it appears that for the time being that LACDA is prioritizing the interests of small business owners. According to Emilio Salas, LACDA Executive Director, “We will continue prioritizing the needs of Los Angeles County businesses and doing [sic] what we can to keep their doors open.”

What do you think of the loan program? Do you know someone that would benefit from using it? Let us know in the comments!

Contributor, designer & admin for JohnHart Gazette.