In the land of the free, building wealth is about as American as free speech. But, the reality is that income and racial gaps have prevented an overwhelming number of black families from pursuing homeownership in the United States. The sad truth is that numerous factors contribute to the stark statistical imbalance regarding Black homeownership.

In July 2019, the reported Black American homeownership rate hit 40.6%, a historic low. That number is so low, in fact, it mirrors the rate at the time of the passing of the Fair Housing Act of 1968. For that figure to stagnate after 50 years is staggering, to say the least. Even more eye-opening? The rate reported for non-Hispanic White Americans for the same period in 2019: 73.1%. Let’s take a deep dive into the many factors contributing to the income and racial gaps in black homeownership:

The Lasting Effects of Redlining

The Fair Housing Act of 1968 was created to address redlining, a discriminatory housing policy outlawed by the act. That racist policy involved assigning grade levels and color codes to neighborhoods to illustrate local lenders’ perceived credit risk based on residents’ race and ethnicity. The result was urban areas with a large share of black families being redlined — effectively making it nearly impossible to qualify for a mortgage.

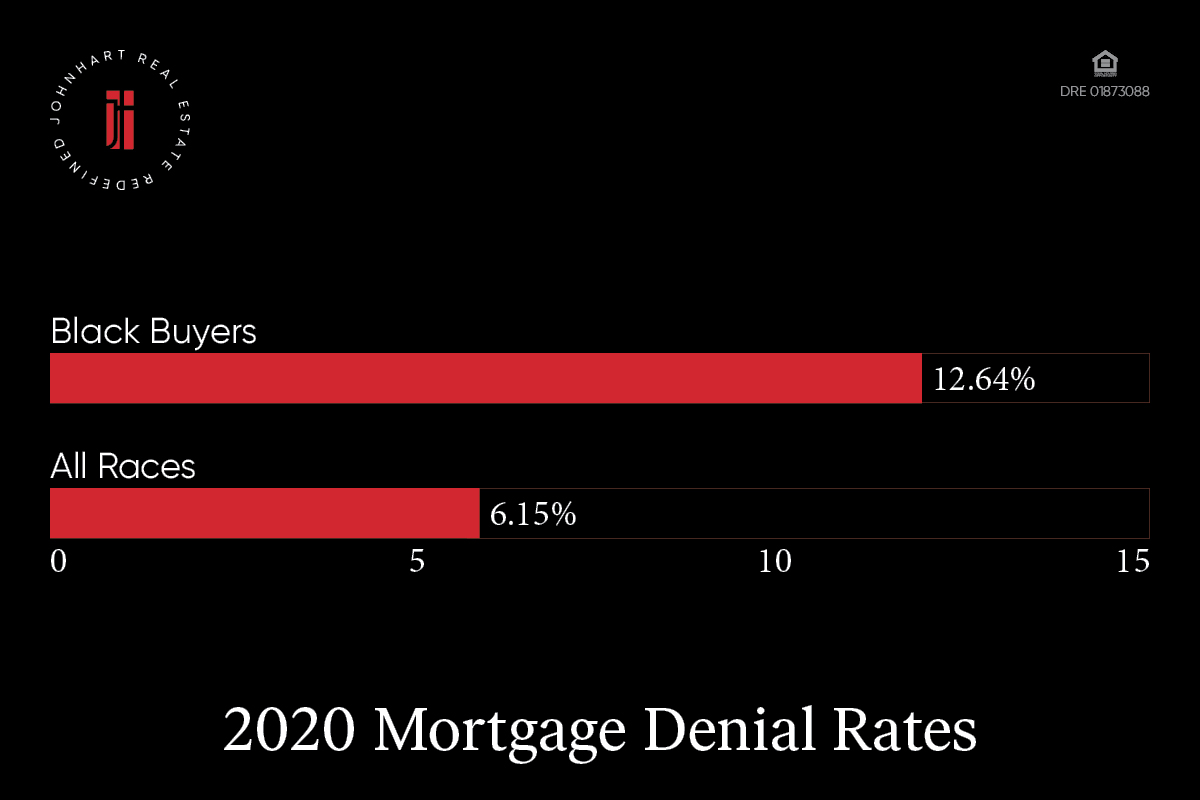

Redlining and discriminatory practices also negatively affect modern mortgage rates. Specifically, black buyers today experience a mortgage denial 12.64% of the time, more than double what all races encounter at 6.15%. That discrepancy is alarming and reflects the sustained myriad of hurdles facing prospective black homebuyers today.

Linked to the Educational Gap

Unfortunately, discrimination has a way of touching multiple aspects of livelihoods and communities. In a recent Washington Post article, Sheharyar Bokhari (a senior economist with Redfin in Cambridge, Massachusetts) noted the trickle-down effect, “The education achievement gap is tied in with redlining because the lack of investment in black neighborhoods included a lack of investment in schools…The education gap limits opportunities for a college education and for a better job, which in turn affects income levels.”

A Generational Problem

Redlining has had such long-lasting effects over generations, that potential black homeowners in their 40s and 50s became wary about trying to buy. Mortgage lenders doled out Subprime loans to these age groups, which only compounded their cautious attitudes. Plus, black buyers are less likely to receive assistance from their parents if their parents don’t own a home themselves. Try as they might, the statistics illustrate that black Americans have had the cards stacked against them in their quest to own a home for many years. The uphill climb is fraught with complications, and the multilayered problems of today require multi-pronged solutions for a better tomorrow.

The Black Real Estate Agent Program™

Exacerbating the homeownership disparity is the lack of Black real estate agents and brokers in our country. According to research from Deloitte, fewer than 6% of active real estate agents and brokers identify as Black. This is especially significant when you consider that 11% of the American population identify as Black. As a response to that low figure and the 2020 Social Justice Movement, HomeLight and NAREB recently teamed up. The duo announced the creation of the Black Real Estate Agent Program™ last month, in February 2021. The intention is to close the income and racial gaps in real estate.

The Road Ahead

Hopefully, the efforts by NAREB can be coupled with other efforts to close the income and racial gaps our country currently endures. The roots of the black homeownership disparity run deeply in our country. Combatting that homeownership gap depends on numerous other steps, including (but not limited to):

- Address housing supply and finance challenges

- Help more renters become homebuyers

- Strengthen government mortgage programs

- Sustain homeownership through all economic cycles

Ultimately, every American deserves to own a home. Building wealth through homeownership is such a critical part of creating lasting, multi-generational wealth. In the end, genuine change will only occur once substantial shifts happen across the real estate spectrum. This means shifts in the attitudes of mortgage lenders and in the perspectives of prospective black homebuyers. The road toward closing the racial and income gaps in Black homeownership is long, but hopefully shedding more light on the problem now can get the ball rolling in the right direction — in the direction of a more equitable market for all.

Contributor, designer & admin for JohnHart Gazette.